“It was a solid start to the year as we executed well on our priorities,” said David Zinsner, Intel CFO. “The current macro environment is creating elevated uncertainty across the industry, which is reflected in our outlook. We are taking a disciplined and prudent approach to support continued investment in our core products and foundry businesses while maximizing operational cost savings and capital efficiency.”

Driving Greater Execution and Efficiency

Intel is taking actions to drive better, more efficient execution across the business. The plan includes streamlining the organization, eliminating management layers and enabling faster decision-making. In taking these actions, Intel will focus on empowering engineering talent to create great products and driving greater accountability across the company while making it easier for customers to do business with Intel.

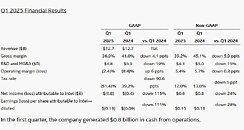

In line with these actions, Intel is reducing its non-GAAP operating expense target to approximately $17 billion in 2025, down from its previously stated goal of $17.5 billion, and is now targeting $16 billion in 2026. Operating expenses include research and development (R&D), and marketing, general and administrative (MG&A). Intel expects to have restructuring charges associated with these actions, some of which may be included in its non-GAAP results. Since the company has not yet estimated these charges, they are not included in its guidance.

Additionally, further operational efficiencies and better utilization of construction-in-progress assets allow Intel to reduce its gross capital expenditures target to $18 billion for 2025, down from the company’s previous target of $20 billion, while still expecting net capital expenditures of approximately $8 billion to $11 billion. Intel will continue to focus investment in its core business as it drives operational efficiency.

Business Unit Summary

In the first quarter of 2025, the company made an organizational change to integrate the Network and Edge Group (NEX) into CCG and DCAI and modified Intel’s segment reporting to align to this and certain other business reorganizations. All prior-period segment data has been retrospectively adjusted to reflect the way Intel’s chief operating decision maker internally receives information and manages and monitors the company’s operating segment performance starting in fiscal year 2025. There are no changes to Intel’s consolidated financial statements for any prior periods.

Business Highlights

- At CES, Intel announced the new Intel Core Ultra 200V series mobile processors with Intel vPro, Intel Core Ultra 200HX and H series mobile processors, Intel Core Ultra 200U series mobile processors, and an expanded Intel Core Ultra 200S series desktop processor portfolio.

- In February, Intel launched new Intel Xeon 6 processors with Performance-cores (P-cores) for data center and Xeon 6 processors for network and edge applications, providing enhanced performance and efficiency across workloads.

- In April, MLCommons released its latest MLPerf Inference v5.0 benchmarks, in which Intel Xeon 6 with P-cores demonstrated a 1.9x boost in AI performance over the previous generation of processors, affirming Intel Xeon 6 as a top solution for modern AI systems.

- Intel 18A is expected to ramp in the second half of 2025 to support the launch of Intel’s first Panther Lake SKU by year-end, with additional SKUs coming in the first half of 2026.

- Earlier this month, Intel announced an agreement to sell 51% of its Altera business to Silver Lake. Intel will own the remaining 49% of the Altera business, enabling it to participate in Altera’s future success while focusing on its core business.

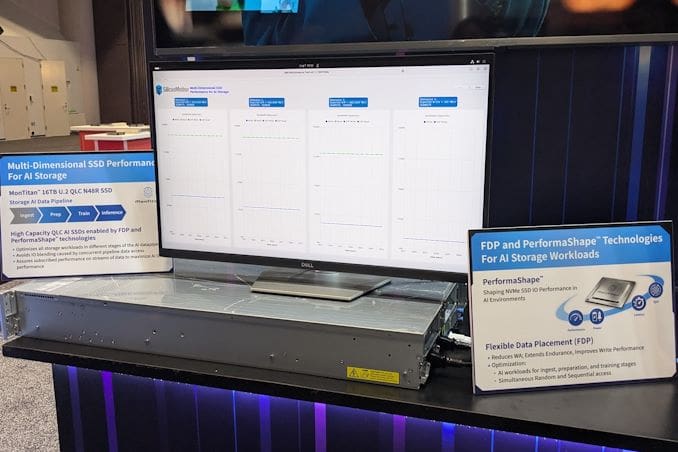

- In March, Intel completed the second and final close of the sale of its NAND business to SK hynix.

The slide-deck follows.